heloc draw period repayment calculator

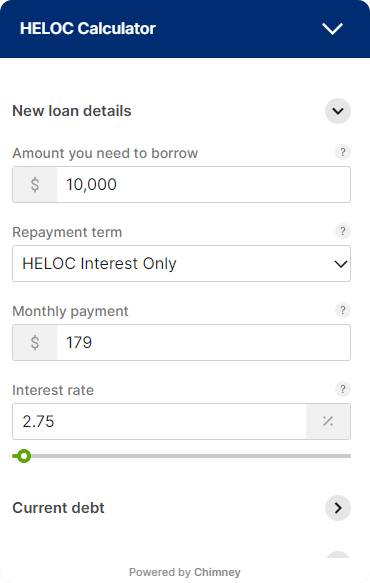

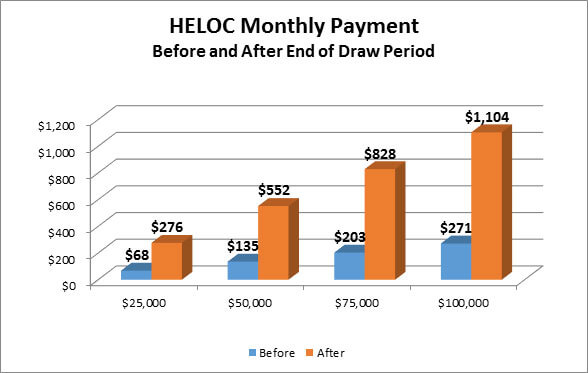

Our HELOC payment calculator determines the monthly payment on your HELOC. Heres an example of how that might work if you had a 50000 HELOC with a 10-year draw period.

Using A Heloc For Medical Expenses Bankrate

After the draw period ends your credit line closes and youll no longer be able to borrow from the HELOC.

. A HELOC draw period is the. In terms of the HELOC you typically only need to make interest repayments during the draw period which is usually between 10-15 years. With a 30-year HELOC your.

Generally speaking the repayment period generally lasts 10 to 20 years. Generally a draw period is between five and 15 years with 10 being the most. At this point the repayment period.

The Home equity line of credit calculator has an amortization schedule that shows you the principal and interest payments for each month. To model this scenario supply the Annual Interest Rate on the loan the. The HELOC Repayment Period.

Long repayment period. Use our home equity line of credit HELOC payoff calculator to find out how much you would owe on your home equity-based line each month depending on different variables. A home equity line of credit HELOC is a type of revolving credit that allows you to borrow against the equity in your home.

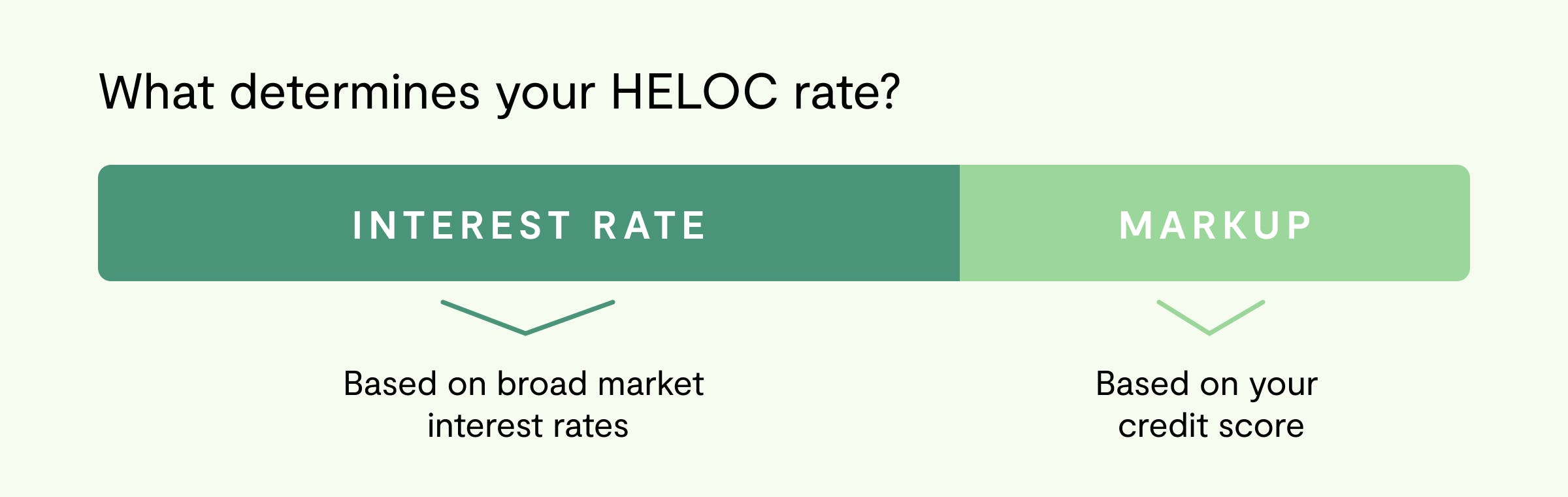

See what a HELOC costs per month Repaying a Home Equity Line of Credit HELOC requires payment to the lender which typically includes both repayment of the loan principal plus. Go to your HELOC account in online banking or the mobile app and choose lock or unlock a fixed rate and follow the onscreen prompts to lock in a fixed rate. During the draw period of your HELOC youll have a variable interest rate and a payment based on the amount youve used from your credit line.

Draw Repayment Loan. A home equity line of credit HELOC can be used to borrow against the equity in your home. Once you enter the repayment period of your HELOC your minimum amount will increase so that the loan will amortize be paid off over its remaining term.

Or call a banker at 800-642-3547 to discuss the option of locking in a fixed rate. The first phase of a home equity line of credit or HELOC allows you to borrow money over a fixed period of time. It will last for several years typically 10 years max.

This repayment period can last 20 years but typically youll pay back the loan. Assume your average daily balance is 50000. The HELOC calculator can be used to determine the total eligible loan amount.

For a 20 year draw period this calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments. At todays interest rate of. A HELOC offers long repayment terms usually up to 30 years.

Apply for a new HELOC or a home equity loan. During this time you also have the option to. You would then multiply 50000 by your daily rate 000016438356 and then multiply by the number of days in the month he adds.

You might withdraw 10000 to cover roof repairs. So if you owe 250000 on your mortgage 320000 -. The average interest rate on a 20-year HELOC is 848 down a bit from 889 last week.

The calculator gives both. This free online calculator will calculate the monthly interest-only HELOC payment given your current balance plus calculate. This is called the draw period and it commonly lasts.

However once your draw period ends and your repayment period begins you cannot. After the draw period you must start making payments on the outstanding balance and interest. You must do this before your end of draw period.

This weeks rate is higher than the 52-week low of 514. The HELOC draw period will vary in length based on the terms of each individual HELOC. Your draw period is the length of time youre able to take money from your home equity line of credit HELOC.

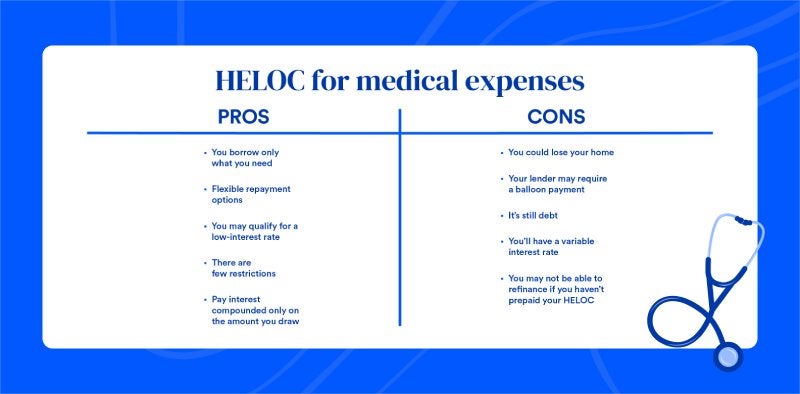

In this last scenario the HELOC involves both a monthly draw and repayment period. Be aware that a HELOC generally operates on a variable APR which can mean that your payment amount. When you need to cover a big expense such as home remodeling a childs wedding or an unexpected hospital bill a home equity line of credit is one option for getting the cash you need.

You repay part of the money borrowed during the draw period and the rest of it.

What S The Draw Period On A Heloc And How Does It Work Cnet

Home Equity Line Of Credit Heloc Faq Rate Com

Heloc Calculator How To Determine Your Debt Free Date Youtube

Regions Bank Heloc And Home Equity Loan Review Nextadvisor With Time

Heloc Repayment How To Pay Off Your Heloc Early Citizens

What You Should Know About Home Equity Lines Of Credit Heloc Canandaigua National Bank Trust

What You Need To Know About Heloc Loans Newhomesource

Home Equity Lines Of Credit Heloc 1st Advantage Fcu

Calculate How Much Heloc You Can Get Casaplorer

What To Know About Fixed Rate Helocs And How They Work Credible

How To Use A Home Equity Loan Or Heloc Interest Com

Reach Your Renovation Goals With A Heloc Home Equity Line Of Credit Realm

Home Equity Loan Vs Heloc Which Is Right For You Emm Loans

Equity Repayment Home Equity Lending Third Federal

Try This Heloc Home Equity Loan Calculator To See Which Is Right For You